Add House To Quicken 2015 For Mac

I was component of the beta screening team for this item and, in my opinion, it has been released method too soon. It provides lots of bugs plus it offers less features and a great deal of distinctions from the Quicken Home windows version which many people are usually used to and expect to find on the Macintosh edition. I think Intuit launched it earlier because so many individuals have inquired for a product for Macintosh, but that's no reason to release it before it's prepared. Possibly, some may say it's much better than no Quicken for Mac pc as it's at least much better than Essentials. That'h like stating a three legged horse is much better than a twó legged oné.

Although you can add a tax schedule in Quicken for 'Asset' accounts, it is best to skip this option as it gives you more control over handling the tax payments. Account Setup 1. Finally decided that I would start from scratch with the Quicken 2015 for Mac, creating a new file altogether. No conversions. I intend to run both Quicken Essentials and Quicken 2015 until the year end than, starting 1st January, I will go with Q2015 alone. The conversion was a disaster. Quicken 2019 for Windows imports data from Quicken for Windows 2010 or newer, Microsoft Money 2008 and 2009 (for Deluxe and higher). Quicken 2019 for Mac imports data from Quicken for Windows 2010 or newer, Quicken for Mac 2015 or newer, Quicken for Mac 2007, Quicken Essentials for.

My recommendation is certainly that it'h only heading to get much better, (because it can't obtain much worse). If you're also already using Quicken on a Windows computer or possess something else that works for you, l wouldn't purchase it. Wait about a year and I anticipate it will end up being much enhanced. What really stinks for the beta testers can be that we established up our balances on the beta edition and was never told that the software would end at the end of the assessment. (It had been probably hidden in some lawful terms and condition doctor that I decided to.) So I supposed I would end up being permitted to keep the software since I had been expected to use it for all my balances. The software program has right now 'terminated' and I was remaining with either purchasing this crappy version for my Macintosh Quicken document or heading back to the Home windows edition and filling in all the missing weeks when I has been using it on the Macintosh.

Intuit'h mindset towards its Macintosh customers is breathtaking in its degree of arrogance and neglect. I dislike it when a software program firm I've trusted for years places out a product so horrible, pushchair and inexperienced that it can make me ignore why I ever respected them in the initial place. This edition of Quicken was useless on appearance and price me four hrs of my lifestyle I'll never get back again. Allow's begin with converting data from Home windows. You understand how you can make use of Word paperwork on either a Home windows or Mac and the báck-and-forth is certainly seamless? Think about the opposite of that.

Are you visualizing that? It begins when you are installing Quicken.

You are usually setting up it on a Mac pc, because it's i9000 Quicken for.Macintosh. Component of the install is definitely to download thé Converter. You click the link and the converter downloads. You are then told that the converter only runs on a Windows machine. So you have got to exchange the document (or re-downIoad it) on á Home windows pc, which for me was at my workplace where I previously held all my Quicken data files. So I experienced to wait till Monday when I went to function to run the converter.

Then I ran thé converter and emailed the transformed file back again to myself só I could total the transformation that night. (Why can't this version of the software just Examine the information document? Shouldn'capital t it be smooth across systems?) In any case, as soon as I brought in the transformed data, the initial factor I noticed has been my checking accounts balance has been suddenly bad $54,000. Yes, in some way a major financial business's conversion software had been so inefficient that it deducted nearly $60,000 from my checking. I contacted assistance.

They tried to help, but got little to provide but worn apologies. I certainly not figured out why the amounts were so far away, but one factor I found out in one account has been two months worth of transactions that pre-datéd when I in fact opened the account at the loan company. The dealings appeared to possess arrive from one of my shut accounts. Therefore, somehow the globe's major financial administration software business had written a information converter that cannot complement dealings to the appropriate accounts when transforming the information. I believed maybe going online and getting the software contact bottom with my banking institutions would help. The software program was incapable to match ANY of my existing accounts with their on-line counterparts.

How really difficult can this become? My accounts numbers are rescued in the information document. All you possess to perform is suit them up.

Instead, the software created DUPLICATE variations of every accounts, doubling the number of accounts which, while nearer to having accurate balances, were nevertheless wrong. Sitting staring at an user interface that informed me simply because very much about the actual condition of my finances as my pet could, I offered up. If you perform purchase the software program, you'll need this hyperlink to obtain a discount: Crazy, they can get your money immediately, but you gotta provide them 4-6 weeks if you desire it back again.

I have been using Quicken since its best times of Quicken for Windows. When I moved over to the Apple OSX system, I completely expected Q for Mac to be basically the same plan - after all, real tools are usually obtainable to create software supply program code that can be relatively simply compiled to focus on both the Windows and the OSX platform.

What I found, instead, was that Queen for Mac pc bore extremely little resemblance to Queen for Home windows. They did not have got any some other solution for their newer variations of 0S-X for ovér three decades. At that time they launched a wrapped version of Queen2007 for Macintosh which would run on newer Intel-based Apple computers - no enhancement, just wrapped. When I noticed Queen 2015 for Macintosh, my hopes were elevated, and I bought this deal. I brought in my data, and found how to do very much of what I require in the new user user interface. The data did not really import without copious errors - it took three solid times of work to clean up the information in two pension annuities.

To tackle the difficulties in my IRA, a individual investment accounts, and two checking out balances would take many extra days. But I could at rent begin to make use of the matter for controlling my potential finances - or so I thought. Today I started addressing my spending budget, which I acquired been able to take care of appropriately in Queen 2007. Now there, I discovered that a budget could become maintained in Q 2015 just one 30 days at a period, whereas under Queen2007, I was capable to established up a budget for an entire 12 months, and track my budgetary compliance simply from there.

The human being user interface on the spending budget side of this program is quite poor. They have no like facility for genuine long-range preparation.

To make things worse, Intuit seems to have abandoned their previous plan of supplying customer program on software program for three decades after buy. I can't also find a phone number for Intuit anywhere on their web site. Their support policy currently offers a bulletin-board-like 'Area' where you may blog post questions, and wish that another associate of the local community will have got, and actually take period to publish, an response. This item is unbelievably incomplete, and not very well thought out there, and I say this with over twenty decades of experience as a teacher of electrical engineering, computer research, and software engineering. Long story reduced, I'michael uninstalling the software program and getting my money back again. I would have got continued trying (demos) other personal financing software program if I got recognized what I right now know.

There is usually no reimbursement if you purchase from amazon . com.

It't on the product web page but I didn't notice it or think I would have got so several difficulties. Before I bought Quicken for Macintosh 2015 I didn't recognize that there has been no method for the “Quicken software program to learn a QIF formatted file.” If you're using any non-Quicken personal finance (money administration) software program that doesn't move to a QXF file, you received't be able import it to Quicken for Mac 2015. I'm not sure if it's probable to import OFX files. In situation you're wondering QIF = Quicken Interchange Structure. In a talk Quicken's Renelyn mentioned, “we will have got to transform it to a QXF document first therefore that your Quicken software program would become capable to go through it. If it is definitely a document from your bank or investment company, you can demand for a QXF document format therefore that that would be a lot less complicated for oyu.” FYI: The transformation software that she suggested had been an extra $37 from a third-party seller.

USB C Mouse, INNOMAX MacBook USB C Wired Mouse, MacBook Wired Mouse, Mouse MacBook Pro 2016/2017,MacBook 13', Surface Book 2, Lenovo Yoga 900/920, Lenovo Yoga 720 and Computer with USB C by INNOMAX $6.99 $ 6 99 Prime. Best mouse for mac pro 2017. And of a lot of cheap mice, this is the best we found. If you are looking for a wireless Bluetooth mouse for under $20 for the MacBook Pro 2018, this is the best there is. One of the reasons why this mouse made it into the list of 5 Best Mice for MacBook Pro 2018 is the fact that is it extremely reliable. If Apple Magic Mouse doesn’t suits your budget or if you are already having it and you are not happy using it for any X reason then I would suggest you some these Wireless mouse for Mac and then pair your wireless bluetooth mouse with MacBook Pro and start using it. Which is the best mouse for a Mac? We help you choose the best mouse for an Apple Mac as we check out the best mouse options for a Mac user. Why Apple's Magic Mouse is the best wireless mouse for Mac. Frankly, it's the multitouch surface that won me over. You can swipe with one or two fingers to perform navigation actions on documents and websites. You can right or left-click to call up option menus.

Purchaser beware. In addition, if the over didn'capital t distress you aside be sure that your enrollment security password for the Quicken for Mac pc 2015 software (or your loan provider password) will not have got any unique character types or you'll obtain an mistake message.

When you sign-up at the quicken/intuit internet site, there won't be any instructions or warning since the website itself accepts special heroes. This is usually the error information I received. 'Invalid Credentials. Gain access to Denied. This error can end up being caused by making use of special character types in the password used to link to the economic organization through Quicken, and can be accompanied by an mistake code (typically 103). To solve this issue, please modify the security password to not consist of any specific figures (make use of alpha numeric only). This concern will end up being resolved in a upcoming discharge of the system.

' FYI: This details was submitted on the quicken/intuit internet site in 2012 so I'm sure a answer to the zero special character rule is definitely best around the part in 2016. With so many initial complications, I haven't acquired a opportunity to use the software program. If I could give this product ZERO moon, I would perform it. Until this summer time, when my pc melted lower, I had 20 yrs' value of information in a Quicken document, and acquired been fighting mightily with an outdated Mac and Quicken 2007 (Queen2007).

Several of you who are usually longtime Macintosh users understand the problem: Intuit provides not really cared about its Macintosh clients for yrs. First they left us higher and dried out when Apple released Operating-system 10.7 and Intuit provided no update for numerous, many months, while trying to market us on the vastly substandard Quicken Necessities (QE). I reacted the only method I could, which was that I didn't enhance my OS. Much better to have got an old OS than risk all those years of monetary data heading down the tubes! I has been very thrilled to listen to about Quicken 2015 (Q2015), but it transforms out that Queen2015 doesn'capital t provide actually the simple features that Q2007 did.

You'll read elsewhere about reviews being inadequate. They're also terrible.

But the genuine problem will be that Queen2015 offers discontinued double-entry bookkeeping and offers instead made a unnecessarily challenging 'transfer' process to shift cash between balances. WHY IN THE Entire world WOULD YOU TAKE SOMETHING SO ELEGANT AND SIMPLE AND MAKE It all NEEDLESSLY COMPLICATED?!? In Queen2007, to exchange money between balances you just required to use the bracketed Accounts Title in the 'group' part of the sign up and Quicken would produce mirror transactions: a debit in one account and a credit in the other. Better however, if you were transferring money into an investment decision accounts, you could buy shares making use of that really same entrance. Right now, in order to achieve the same point, you'll need one access to supply 'cash in' to your expense account, and after that a 2nd one to 'purchase' stocks of your expenditure. So what used to be basic, with simply one entrance, now requires two. The true a weakness of this will be apparent to anyone who has a Queen2007 document that will get 'updated' in Q2015.

This fresh edition of Quicken will not really realize your items. When you 'update' your accounts with your expense house, your totals will be wildly away, and you will have got to change EVERY SINGLE investment deal to develop TWO dealings on the exact same date. This is certainly insanity. Mac customers would end up being satisfied with an up to date version of Q2007.

Just provide us WHAT WE ALREADY HAD 7 YEARS AGO, but this period with technology. Or at minimum updates every now and after that. I put on't also need all the stuff that Personal computer users state is therefore great about their version of Quicken. Just give me WHAT I ALREADY Have got, ONLY UPDATED, so banks and investment homes will keep on to web page link to it. Quicken will be wondering which features we'd like to possess as Q2015 can be upgraded gradually. Let me try out to reply to that: Why would you not really Begin with the item you experienced in 2007 that had been successful? Provide ALL those features.

Add House To Quicken 2015 For Mac Download

We need something that provides a seamless transition from Q2007, and Queen2015 won't perform that if you muck around with it this much. Stop trying to reinvent the wheel. Oh, ánd if yóu must up grade Queen2015 gradually, after that your Initial update should be to return to double-éntry bookkeeping.

I bought Quicken 2015 because, relating to the site, 'Quicken communicates directly with your lender.' This is usually, in fact, false. Hidden below, in a click-through link, it states that,. Your login credentials are kept on Intuit-hosted servers. This makes updates quicker for you. Your economic data can be saved on Intuit-hosted computers.

This offers a more complete background of your financial dealings than is usual for information stored on financial institution hosts. I wish intuit to have got neither. This is never produced apparent and obvious during the setup. I discovered this out, because their provider that logs in to your lender was down, and I was incapable to revise. I'meters sickened by their deceptiveness. Update 10/11 In inclusion, the app does not revise account purchase information correctly. It will inform you that the revise finished, and that zero dealings had been downloaded.

However, when I record in to my monetary institution, I discover several transactions that in no way made it. Deceptive and difficult to rely on. Exactly two issues I put on't need from a economic service service provider. Worst edition ever! Stick with Quicken 2007. 2015 appears to have been thrown together without much forethought. Menu/view options are hidden, requiring a right click on to find items.

It't non-intuitive, missing a consumer friendly interface. The reports are pretty much disfunctional. All the excellent ways to arrange and categorize reports are usually gone. Extract product key for office mac 2011. There's no way to improve a statement by payee, mémo, or any additional of the helpful reviews and graphs I've long been used to as a Quicken user since the 90'h. It't irritating to spend for the software, considering that it'h an upgrade, just to find it to be worthless.

In order to use a document from Quicken 2006, you have got to update to Lion 2007. Not really simply any 2007, but the one released for the Lion Operating-system. Intuit states that it's rewritten the Quicken program code from the bottom upward and that'h why it's missing features. Why launch it if it's not prepared? Intuit continues to display it's i9000 lack of assistance for the Macs platform. The unique DOS version of Quicken had better functions and features than this Mac pc discharge.

Quicken, you ánd I shall portion methods, after a 20 yr friendship. So I read through the horrid testimonials but they had been when the software just came out.

Most were the standard moaning groaning nasal area pickers griping about some special super key statement that didn't function the exact same as it do on software program from 8 years ago. Zero one bothered to mention features or performing normal stuff. Well here you go folks!

The break down. You state you desire to import your Standard bank's things? One or twó of mine actually linked up. The others (these are usually all MAJOR companies so no reason for this) all have got to become personally downloaded each and every 30 days. I might mainly because well obtain the papers statements and do it with án abacus. Oh, yóu wish to arranged up your fresh car loan? Good good fortune with all that.

You much better endure on one feet, cross the still left eye, hold out your left arm, and create a duck quáck with your remaining big bottom. And also then, it will not perform the most basic stuff. Quicken didn'testosterone levels even possess the guts to contact it a mortgage. It'h a liability. That's right! You can't inform your personal computer software program what the attention rate is definitely or terms or anything.

You simply inform it what the responsibility is worth. Then you, yes you; Obtain to do all the manual calculating of attention and principle for every payment! You would perform better with a stone, a chisel, and 16 toes. I don't understand bout you people, but I possess this $2000 personal computer right here who's whole purpose is to calculate items. I paid for software program that should end up being capable to determine out Once a month transaction = rate + rate / ( (1+price) ^ a few months -1) back button principal mortgage quantity.

I don't see no Elizabeth=MC2 up presently there. Looks like some simple rymatic to mé. But ole CIetus over presently there at Intuit appearanly ain't gots no iders how in the tarnation them town slickers figur thangs like loan products an such. Chat about a Main allow down.

To create it actually even more fun: I have got to wait 34 weeks for a check out via snail-mail. I imagine Intuit wear't like Amazon . com none too good. I paid in secs but I possess to wait around for a 30 days for a document check. Those men are usually rocking the client service.

Allow me tell you. Unnecessary to state, they have damaged their credibility. I are seriously wanting to know if I should carry on using Turbo Tax. Other software does just fine. I imagine how they react to my discount request and just how long I have got to wait around for my check to end up being mailed via snail mail will figure out that.

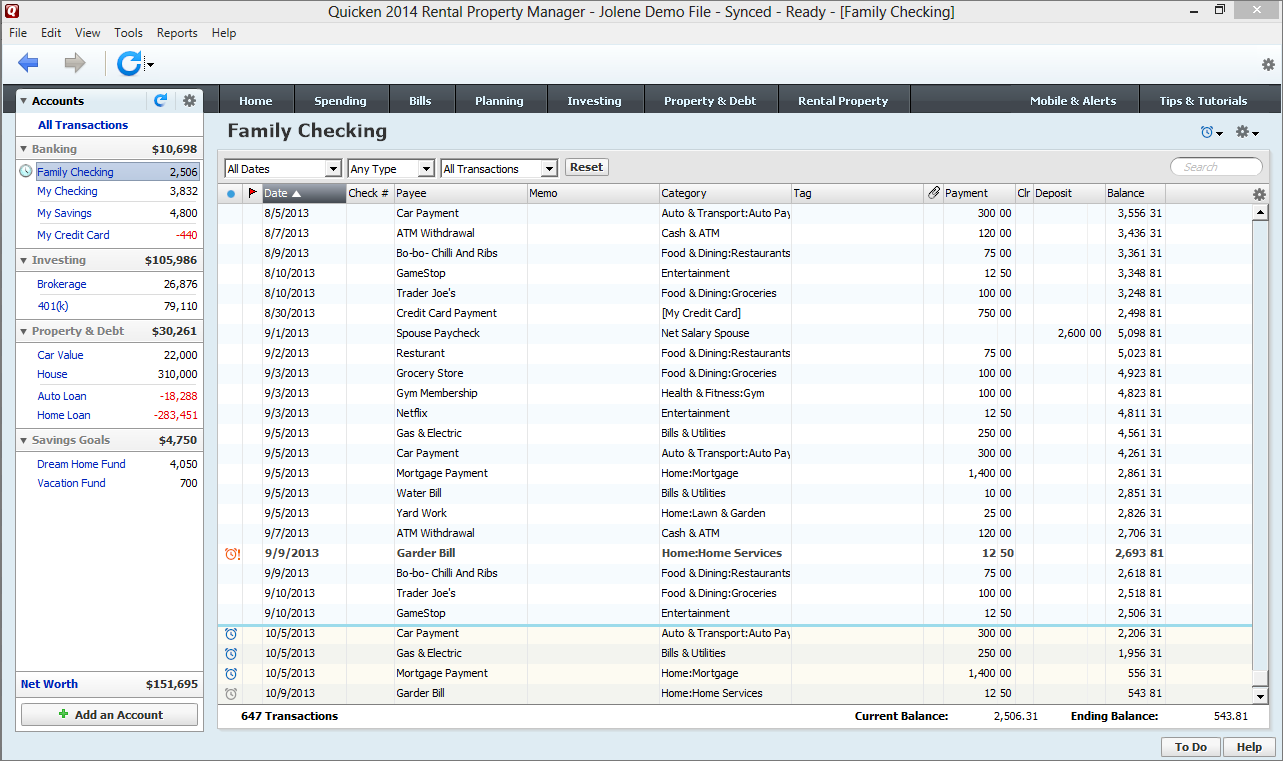

Create New Document. Select New Quicken Accounts. Add Accounts.

Select Broker under Primary Accounts. Include Brokerage Account. Type American Money in the window. Click on Next. Add Brokerage Account (Continued). Enter your Sociable Security quantity and americanfunds.com security password. Click Connect.

Notice: You can enter your fund and accounts number separated by a comma instead of your Sociable Security amount (age.h., 8). Accounts Added. Review the overview of accounts and dealings included to Quicken. Click Finish.

Our brand-new online bank up-date will require a Quicken up-date. You will require to alter your Quicken settings to assure the smooth changeover of your information. Please guide the times following to each job as this details is time delicate. To total these instructions, you will require your Consumer Identity and Password for each Financial Organization. You should perform the right after instructions precisely as explained and in the order presented. If you do not, your on the web banking connectivity may quit functioning correctly.

This transformation should get 15-30 mins. Phase 1: Transformation Preparation. Back-up your data file. For directions to back up your data file, choose Help menu >Research.

Search for Support Up, select Support up data data files, and stick to the instructions. Download the most recent Quicken Up-date. For guidelines to download an upgrade, choose Assist menu >Research. Search for Improvements, select “Check out for Updates,” and follow the instructions. Phase 2: Connect Balances at Solarity Credit score Partnership on or after July 18, 2017.

Select your accounts under the Balances list on the remaining aspect. Choose Accounts menus >Settings. Select Set up purchase download. Enter Solarity Credit score Association in the Lookup field, select the name in the Results listing and click Continue. Record in to soIaritycu.org and DownIoad a document of your dealings to your pc.

Move and drop the downloaded document into the box Fall download file.Be aware: Get notice of the date you past got a successful connection. If you possess overlapping times in the web-connect procedure, you may end up with duplicate dealings. Select “Web Connect” for the “Connection Type” if caused.

In the “Accounts Found” display screen, make certain you connect each new account to the appropriate account currently shown in Quicken. Under the Actions column, select “Link” to choose your existing account.

IMPORTANT: Do not choose “Put” under the actions line unless you mean to add a new account to Quicken. Click Finish. Do it again methods for each account to end up being connected.